Filing your income tax return is a legal obligation for eligible taxpayers in Bangladesh and a critical step in contributing to the country’s development. The National Board of Revenue (NBR) has simplified the process by offering both online and offline filing methods, allowing taxpayers to choose according to their preference and convenience. This detailed guide will walk you through the entire process, including updated regulations for 2024, ensuring accuracy and compliance.

Why Filing Taxes is Essential

- Legal Requirement: Complying with the Income Tax Ordinance of 1984, as amended in 2024, is mandatory for individuals and entities with taxable income.

- Civic Duty: Your taxes fund public services, infrastructure, and national programs.

- Avoiding Penalties: Late or inaccurate filings can lead to financial and legal consequences.

- Financial Benefits: Filing returns enables you to claim refunds and tax credits and demonstrates financial transparency, which is crucial for business or loan approvals.

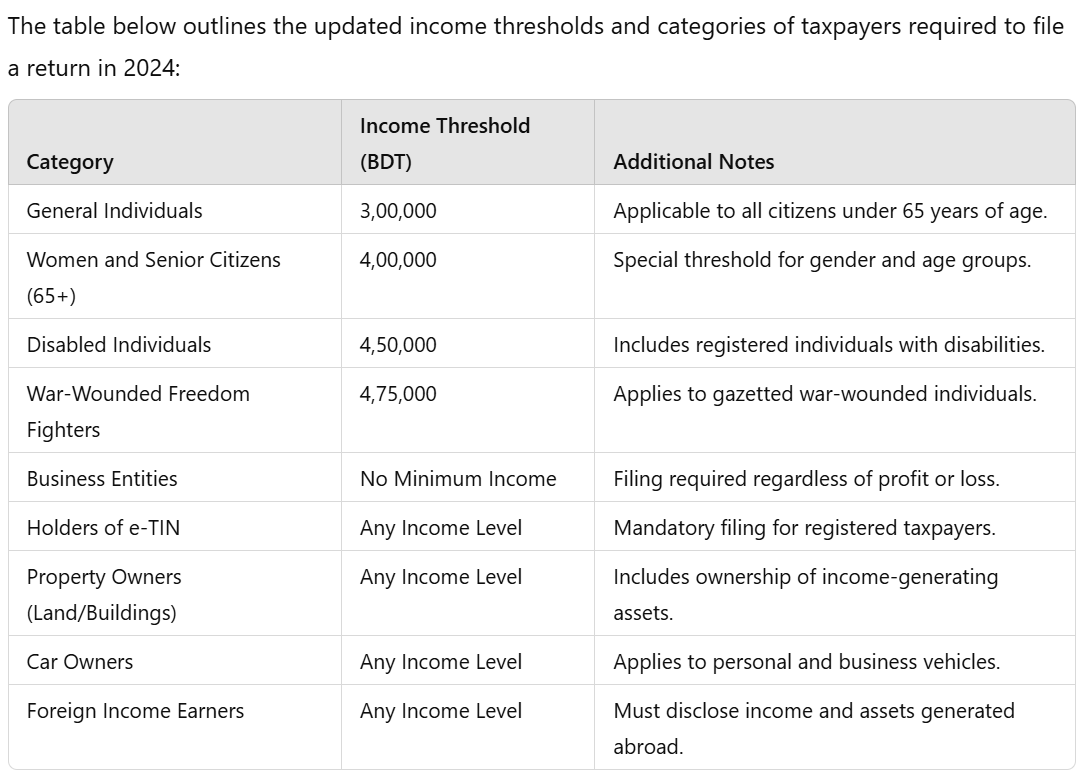

income Tax Filing Eligibility

Documents Required for Tax Filing

Ensure the following documents are ready before starting the tax filing process:

- Personal Identification:

- National ID (NID) or Passport

- e-TIN certificate

- Income Details:

- Salary slips, business income records, rental income statements, etc.

- Foreign income documentation (if applicable).

- Expense and Deduction Details:

- Investment documents (e.g., savings certificates, insurance premiums).

- Proof of expenses eligible for tax rebates.

- Asset Documentation:

- Property ownership papers

- Vehicle registration documents

- Bank Statements:

- Bank statements for the fiscal year

- Proof of tax deductions at source (TDS).

Step-by-Step Guide: Filing Tax Returns Online

The online system introduced by NBR has revolutionized tax filing in Bangladesh. Follow these steps to file your taxes online:

1. Register on the NBR e-Tax Portal

- Visit the NBR e-Tax Portal.

- Use your e-TIN and NID to create an account.

- Complete the OTP verification sent to your registered mobile number.

2. Log into Your Account

- Access the dashboard using your e-TIN and password.

3. Prepare Your Tax Return

- Select the assessment year (e.g., 2023-2024).

- Fill in income details, tax deductions, exemptions, and rebates.

- Upload required supporting documents in the prescribed format.

4. Review and Submit

- Verify all entered data to ensure accuracy.

- Submit the return and download the acknowledgment receipt.

5. Pay Taxes (if applicable)

- Use online banking, mobile financial services (MFS), or pay at designated banks.

Step-by-Step Guide: Filing Tax Returns Offline

For taxpayers who prefer traditional methods, follow these steps for manual filing:

1. Collect the Tax Return Form

- Download the return form from the NBR Website or collect it from the local tax office.

2. Complete the Form

- Provide personal, income, deduction, and investment details.

3. Attach Supporting Documents

- Include income records, investment proof, and asset documentation.

4. Submit at Local Tax Office

- Visit the designated tax circle office to file your return.

5. Obtain Receipt

- Ensure you receive a stamped acknowledgment slip for your records.

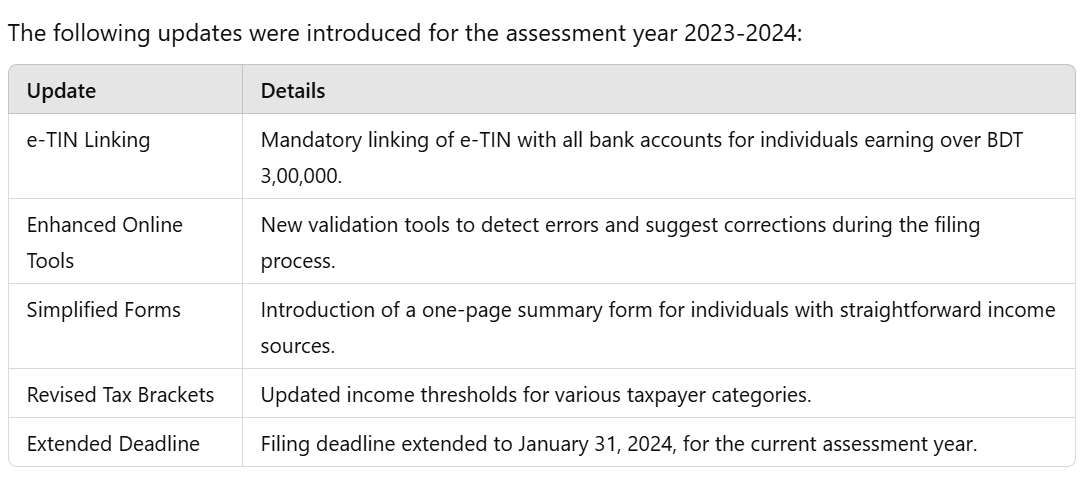

Key Updates for 2024

Common Mistakes to Avoid

- Incorrect Income Disclosure:

- Underreporting income or omitting foreign income.

- Missing Deadlines:

- Filing after the due date results in penalties.

- Inaccurate Deductions:

- Claiming ineligible expenses or rebates.

- Documentation Errors:

- Failing to include necessary supporting documents.

Benefits of Filing Taxes Through Helpink

- Expert Guidance:

- Helpink offers a team of experienced tax consultants to ensure error-free filings.

- Time Efficiency:

- Save valuable time by outsourcing the tedious filing process.

- Comprehensive Compliance:

- Ensure full compliance with the latest NBR regulations.

- Personalized Assistance:

- Tailored services based on individual or corporate tax needs.

- Post-Filing Support:

- Assistance with audits, refunds, or queries from tax authorities.

Conclusion

Filing your income tax return in Bangladesh is now more accessible than ever, thanks to streamlined online and offline systems. By staying updated on the latest regulations and following the procedures outlined above, you can ensure compliance and contribute to the nation’s growth. For professional assistance, trust Helpink to guide you through every step of the process.